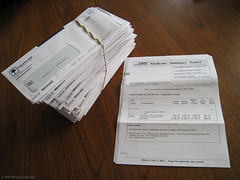

Medical bills can be so expensive that it can be hard to imagine paying for everything in cash. While credit can be helpful for expenses that you need to pay right away, using a credit card with a high interest rate isn’t always ideal for medical bills. After all, you could rack up more than twice what the bill was if you don’t pay fast enough.

There are some other options when it comes to paying your medical bills. Keep reading to make sure you don’t end up skipping medical care for you or your kids when you need it just because of high costs.

There are some other options when it comes to paying your medical bills. Keep reading to make sure you don’t end up skipping medical care for you or your kids when you need it just because of high costs.

Consider Discount Plans

Medical insurance can help you pay for treatment that you need, but in some cases, like with dental bills, insurance isn’t as helpful as you might think. That’s where discount plans that you buy through outside providers can really make a difference.

In general, these discount plans don’t cost very much money at all, and most are less than $20 per month. Unlike medical insurance, they’re more like coupons for services provided by Houston family physicians. For example, a procedure that costs $500 normally could be reduced to $300 if you have a discount plan.

Talk to your doctor about discount plans and see what you can find out. Many doctors even recommend them to all of their patients.

Ask for Discounts

When you get hit with a big medical bill you didn’t expect, it can be easy to panic and worry about how you’ll ever pay them off. Have you considered asking your doctor for a discount on your bill?

If you have a good track record with your doctor, or simply a doctor who cares about patients, you might find that they will knock something off the bill right off the top. This is especially true if you’re paying cash or going to put the bill on your credit card on the spot.

Even if you can’t pay all up front, it can’t hurt to ask for a discount on your total bill.

Make Payment Plans

If you can’t pay your whole bill up front, most doctors know that it can be tricky to get their money at all. That’s why most will work with you to make a payment plan that works.

Monthly payments for a year are much better than not getting the full total of the bill for them!

Leave a Reply